2005 was not a great year for financing of new ventures

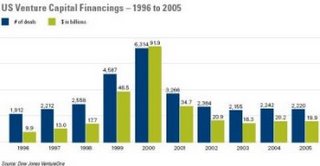

As the chart below shows, while things have stabilized since the downturn started in 2000, we are still at the same level as we were in 1997. And if you are not depressed yet, the report says, "We do not see any developments of trends likely to result in a significant change in the level of venture capital investments in 2006." Ouch!

So what went wrong?

- There are fewer high-quality investment options.

- My research shows that investors have become better at managing risk and no longer trust the entrepreneurs as they did in the past. While it means better scrutiny of business models and working with more conservative estimates, it also means that some promising ideas do not get funded.

- Lack of innovation. That's right. Those of us who watched what happened during the 90s remember very well that some of the best ideas came from innovation (not slick marketing). For instance, e-commerce, nano-technology, broadband, etc.

What can we do to energize the investment climate?

While a lot of TiE community members are too excited about globalization of venture capital activity and argue that merely investing in India and/or China will somehow solve all the problems in the world of investing, the reality is that smart investors do not invest in companies that plan to merely sell more widgets (at some point all markets commoditize). They are desperately trying to find the startups that come up with new business models.

In summary, as you work on new business ideas or seek funding for your existing business, take a look at the degree of innovation in your business. We often tend to forget the importance of innovation, as Clayton M. Christensen (a speaker this year) would tell you.

Posted by: Jay Dwivedi

No comments:

Post a Comment